This can be an e-commerce system or custom software you or your developers have written to interact with the payment gateway. E-commerceįinally, you need a way to sell your stuff in order to initiate a credit card transaction. Most processors will send your application through a 3rd party underwriter for a risk evaluation. They are also the component taking on much of the risk and consequently they will scrutinize you and your business before approving an agreement with you. The payment processor is who you will be entering into an agreement with and they are the ones doing all of the heavy lifting. The payment processor then forwards that response to the gateway for relay back to your e-commerce system. The card issuing bank then performs fraud, credit, and debit checks on the transaction before responding to the processor with an approved or declined status. When a transaction is forwarded to the payment processor from the gateway, the processor then forwards that request to the card issuing bank (or directly to the credit card company in the cases of AMEX and Discover). The payment processor is the service which actually communicates with the credit card companies and card issuing banks. The gateway is the service your e-commerce system uses to interface with the payment processor. The payment processor and payment gateway are two separate entities. When the processor determines if a transaction is approved or declined, it passes that authorization back to the gateway which provides your e-commerce system with a response. You never communicate with the payment processor directly, only indirectly through the gateway.

#Setting up credit card terminal verification#

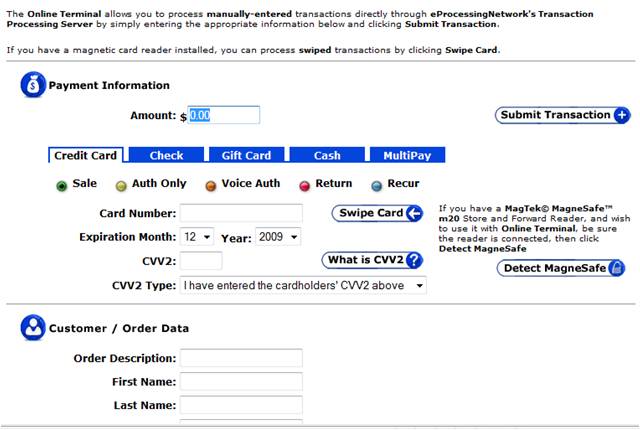

It also commonly performs several anti-fraud measures such as address verification or geolocation checks. The gateway handles all of the sensitive information in a secure way. The payment gateway is responsible for providing the settlement reports as well as initiating refunds and voiding transactions. In fact, they usually provide a virtual terminal to run ad hoc credit card transactions just as you would with a card swiper. It is the virtual equivalent of a credit card terminal or point of sale. The payment gateway is the service your website will use to initiate a transaction and to retrieve feedback such as approval or decline.

*You'll still need a business checking account for your funds to be deposited to. When you enter into an agreement with a payment processor they will assign you a merchant ID to identify you as a merchant but you'll be one step removed from the actual merchant account.įor all intents and purposes, your assigned merchant ID will serve as your merchant account. In web based scenarios, you're most likely not going to be creating your own merchant bank account*, rather you will be entering into a merchant agreement with the payment processor who operates a merchant bank account.

A merchant account is a type of bank account that allows you to accept payments via debit or credit cards.

0 kommentar(er)

0 kommentar(er)